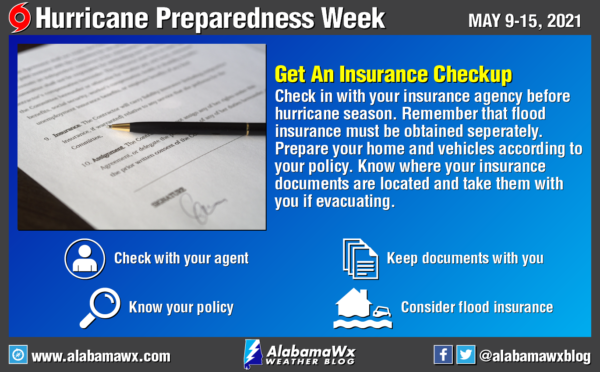

Hurricane Preparedness Week – Day 4: Get An Insurance Checkup

Understanding your insurance needs is an essential preparation step for you and your family. Getting the right type and amount of insurance can help you recover more quickly from disaster and avoid years of financial challenges.

Take steps today to identify and secure the right insurance policy(s) and safeguard your future financial health.

Many different lines of insurance are available to cover different types of disasters. A homeowners’ insurance policy generally provides the following areas of coverage:

• Dwelling – coverage for your house.

• Other structures – coverage for structures such as garages, decks, and fences.

• Personal property – coverage for items such as furniture, clothing, and appliances.

• Loss of Use – compensation if you need to relocate temporarily due to covered damage.

• Personal liability – coverage for accidents occurring on your property.

• Medical protection – payments for a person who is injured on your property.

Most landlords and professional property management companies will require proof of renters’ insurance when a lease is signed. Renters’ insurance policies can include the following coverage types:

• Personal property – coverage for items such as furniture and clothing.

• Loss of Use – compensation if you need to relocate temporarily due to damage.

• Personal liability – coverage if sued due to accidental injury to others.

• Medical protection – payments for a person who is injured on your property.

• Property damage to others – coverage if you accidentally break or damage someone else’s property.

The insurance industry identifies the cause of loss, such as fire or theft, as a “peril.” Insurance only applies when the covered peril (i.e., hazard) that caused the loss is part of a policy. Be sure to check your policy to determine which perils (hazards) are covered. A homeowners’ insurance policy may provide coverage for different perils for the dwelling and for personal property. The policy may also have different deductibles based on the peril. Always check your individual policy for details.

If it can rain where you live, it can flood where you live, and if you live in a hurricane evacuation zone, you are also at risk from saltwater flooding. Losses caused by flood may not be covered by standard property insurance policies. Tell your insurance professional that you need flood insurance coverage, even if you are not in the highest-risk areas for flooding or mudflows, including flooding caused by hurricanes. Flood insurance coverage may be purchased through the National Flood Insurance Program. Coverage for other hazards, such as mold, may be provided as part of the basic property insurance, but the amount of loss payable under the policy may be limited.

Contact your state insurance department for referrals or information on what coverage is available from your state’s involuntary market, shared market, or a state-backed plan if you are unable to find an insurance company that offers a policy that meets your needs.

Contact your insurance company or professional agent every year for an insurance check-up to ensure your coverages keep pace with your needs, belongings, and the perils you face.

Create and maintain a current home inventory to help determine the correct amount of insurance to purchase before the disaster to support the claims process afterward. Have your current home inventory available to determine the right amount of insurance.

Review whether property insurance policies cover actual cash value or replacement cost. Be sure you understand deductibles, waiting periods before coverage begins, and procedures for notification of insurers when a loss occurs.

Ask your insurance professional about potential discounts, incentives, or other savings available on the cost of your policy. Some insurers offer discounts for the following:

• Purchasing home/renter’s and auto insurance from the same provider.

• Installing smoke detectors, burglar alarms, sprinklers, or other improvements, such as hurricane shutters or reinforced roofing, or other hazard mitigation devices.

• Having a membership in a professional, alumni, or business group.

• Being a senior or retiree.

• Being a long-term policyholder.

Maintain a detailed inventory of your belongings to help make the claims process efficient and swift. Photograph and keep records and receipts for all of your belongings. Remember, you may be entitled to tax credits or deductions for casualty losses, so documentation is essential.

Take photos or videos to record your belongings for your home inventory, but also write down descriptions, including year, make, and model numbers. Take photos or a video of the interior and exterior of your home as well. Store your inventory on a portable computer drive (e.g., CD, flash drive, or external hard drive), in online remote storage (known as “the cloud”), in an electronic file, or write it down on paper. Keep your inventory in a location away from your home where it can be accessed easily after a disaster.

Store insurance policies, deeds, property records, and other important papers in a safe place, such as a waterproof and fireproof box, safe, or bank deposit box. Also, make copies of important documents to include with your disaster supplies and consider storing electronic copies on the cloud. Always use strong passwords that include letters and characters. Keep your insurance policy number(s), your insurance professional/company phone number, and claim filing instructions in a secure, convenient location.

Helpful Links

• FLASH Insurance Guide: If Disaster Strikes, Will You Be Covered?

• Find available coverage at floodsmart.gov.

All information from: NOAA, FEMA, FLASH, The Red Cross, Alabama EMA.

Category: Alabama's Weather, ALL POSTS, Met 101/Weather History, Severe Weather, Tropical